Do You want to invest in rare Whisky?

This article deals with the peculiarities of collecting whisky and gives you important tips for your personal collection. The main focus will be on the rise in value - including examples.

Over millions of years the human species has developed from nomadising primates to Homo sapiens to today's Homo post atomiensis. ;-) Our evolution took several million years, and some important characteristics such as the hunting and gathering instincts secured our survival over the whole time.

In this article we focus on humans as hunters and gatherers. These two characteristics complement each other perfectly. Hunting and holding on to something so we don't lose everything we've worked so hard for again. This instinct presumably developed as a reaction to the seasons with their varying food supply. Care in good time for times of need... these characteristics have been handed down to us over generations. You can see it in little children when they align their beloved toys on the shelf.

Many things are collected in daily life. This collecting instinct is nothing negative. For instance, the collecting passion of the big world religions and their gathering of treasures of all kinds enabled us to understand our history much better.

In the private sector it used to be stamps and china. Later the zeitgeist switched to less expensive goods such as crown corks, beer mats and American licence plates. Today you can't find any object that is not collected. Sugar lump wrappings, matchbooks, pins and whisky bottles are among the least exotic collector's items.

Let's dig a bit deeper. What constitutes a collector's item? At the beginning of a collecting passion there’s a trigger. Your get enthralled by a special gift or you see a small collection of things you'd like to own yourself. In the case of matchbooks it's easy. Whenever you come across one you take it home. In the case of whisky it can quickly become very expensive.

1. The Value of Collections

This leads us to the question of the value of collections. Stamp collections are so out with the younger generation - it doesn’t get any 'outer'. The value of these collections decreases rapidly. More and more collections are inherited and are thrown into the market. Years ago the author of this article tried to sell an inherited, almost complete stamp collection (Germany as from 1933) in a specialty shop. The expert's offer, along with his advice, was shattering. For some few stamps he offered a few thousand euros and told me to use the postage stamps that were still valid and to throw the rest away. - So much for the value of stamp collections.

The value of collector's items complies with the normal economic relationship of supply and demand. Stamps have always been printed in millions - apart from the likes of the Mauritius "Post Office". The old stamps can't be put on letters anymore, which leads to a permanent oversupply.

Furthermore collecting stamps is 'out', and the small colourful pictures, mint or stamped, are just worth a fraction of the value imprinted. Why did people use to collect stamps but not anymore? We can only make assumptions. The stamped stamps were available for free. Foreign stamps roused our desire to see distant places, and one thing led to another. Nowadays we can actually travel to distant places, and less and less letters are written. It's a multimedia world.

2. The Whisky Collection

Things are completely different with whisky collections. Demand is as high as never before, and connoisseurs regularly open and drink the best bottles - despite all the lamentations on the part of the collectors. What can be done against it? Bottle even more bottles? The supply of old malt whiskies is limited. The warehouse capacity remains finite, and demand is increasing. The warehouses are emptying so fast that some distilleries have already begun to issue single cask editions (Bowmore 1957, 1964, Macallan 1946, 1950, Ardbeg 1973, 1975, etc.).

These single cask editions are really expensive. You can pay between 250 and 5,000 euros per bottle. But is the bottle worth that money? Will the price continue to increase? Or has a clever vendor boosted prices by creating an artificial shortage? Along the lines of: "Believe me, this bottle is the very last specimen. It is out of stock. As a collector of XYZ you must have it!"

Please bear in mind: Of each whisky at least some hundred bottles are bottled as you can see with the 'rare' Ardbegs and Springbanks in the pictures above. The bottles leave the bottling plants on pallets. Very few bottles are actually unique specimens. These statements often just force up prices. Please stay critical.

3. How to become a profitable collector?

First Step - All beginning is difficult

The passion to collect is insatiable, and after a short period of time each collector must ask themselves how they also can make money with their knowledge of the item they collect. Stamp collectors used to buy at least four stamps. Two were stamped and two were kept mint. One of each type was put into the collection and two were kept for swapping. A real whisky collector always buys three bottles. One to enjoy, a second one for the collection and a third one for later swapping, when the price has risen accordingly. It's an excellent way to expand a collection. By selling the redundant bottles additional money can be raised in order to fulfil wishes that exceed the collecting budget.

The whisky collecting passion often starts with the wish to own a bottle from each distillery. The path is easy: Buy whatever the budget allows. For about 5,000 euros you can get about 100 bottles from different distilleries and then you first have to save money for a bigger cabinet. At this point at the latest, whisky collectors start to think about their motivation and how to develop their collection. The focus switches slowly from amazing-looking bottles to rare whiskies. As time goes by they realise that the standard bottlings are always available. They grow tired of them and start to look for rarities.

Second Step - Expensive Insights - A Few Rules

At this point I would like to share some insight with would-be collectors. These guidelines have been compiled over ten years, and some things had to be learned the hard way.

1. Budget

Don't simply start collecting without a plan. Define a yearly collecting budget with your partner. That way you save yourself a lot of trouble. Save up at least half a yearly budget so you can buy on the spur of the moment if an attractive offer comes up. Retailers usually don't allow you to reserve a bottle.

2. Strategy

Write down your collecting goals and your collecting strategy. This way you avoid dissipating your energies and buying the wrong bottles - something you will almost always regret afterwards.

3. Control

Keep a record of your purchases and sales. Monitor if you accomplish your self-set goals.

Everyone is free not to follow the rules mentioned above. Without a goal in mind you won't reach a goal. However, simply collecting nice-looking bottles can be fun, too. But, just like with the stamp collection, it shouldn't come as a surprise if nobody wants to have these bottles later.

In August 2002 a renowned whisky collector decided to reduce his giant collection to Islay whiskies only. More than 1,000 bottles, some really rare, were up for sale. After two months only 6% of the bottles had been sold for moderate prices. Who looks for a Coleburn 1972 or a Deanston 17 y.o. anyway?

Last Step - Professionalism

If you follow these pieces of advice you have developed from a common-or-garden collector to a professional collector. You don't collect bottles for their looks anymore but think about the future appreciation value of a bottle before buying it.

It's a small step for you but a giant leap for your collection. In the following paragraphs we're going to strategically choose bottles that could later make thousands of euros at big auctions. In September 2002 a bottle of Black Bowmore was sold for 2,800 euros by a German retailer. The bottle was originally sold for 125 euros in 1995.

You will soon notice that many of the bottles you have amassed until now don't deserve a place in your cabinet anymore. You can't sell them. It's like with the stamps. Everybody has them and nobody wants them. Have a look at the pallets above with collector's bottles. Of these selected, 'rare' bottles there are thousands in Europe. You have to choose carefully to find the bargains among these. - We'll see later how to do that.

What can you do with the surplus bottles? Now the whisky collection can show its incredible advantage over the stamp collection. You enjoy the 'worthless' or let's say 'the bottles that won't rise in value' yourself. You didn't waste money and it's even fun!

4. A Self-test

Are you ready for a little test? The following bottles could be purchased from a European mail order company in 2002 for the following prices (converted into euros). Which ones would you buy hoping for an above-average rise in value?

| Name of whisky | Age | ABV | Price |

|---|---|---|---|

| Banff Chieftains Choice | 18 y.o. | 43% | 46 € |

| Macallan 0,7l + 1,0l | 12 y.o. | 40% | 31 € |

| Macallan | 25 y.o. | 43% | 173 € |

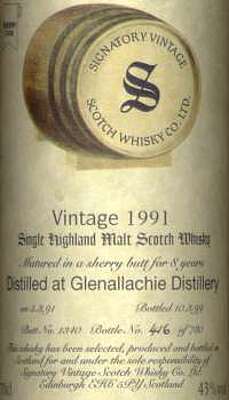

| Glenallachie Signatory | 1991 | 43% | 31 € |

| Springbank | 21 y.o. | 46% | 92 € |

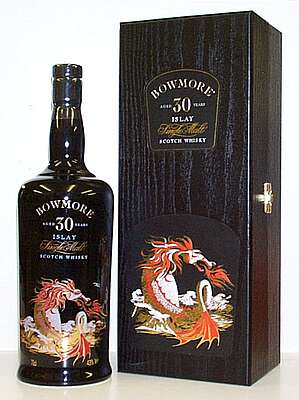

| Bowmore | 30J | 43% | 203 € |

| Loch Lomond | 40% | 20 € | |

| Loch Dhu 1,0 Liter | 10 y.o. | 40% | 49 € |

| Ben Wyvis Signatory | 1968 | 51% | 1150 € |

| Caperdonich G&M | 1968 | 40% | 91 € |

| Johnnie Walker Blue Label | 40% | 127 € |

Many collectors bought these bottles back then. Which ones do you have in your personal collection? And with which result? There are stars among these bottles, but also many lame ducks.

To each bottle belongs a little background story we want to tell here. Of course this is going to take some time, but you as a collector are interested to hear about it. All others have stopped reading by now anyway. Let's get into the details with the 'rare' Banff. After this table more important advice will follow, so please read on.

Banff Chieftain's Choice 18 y.o.

The Banff distillery was already closed in 1983 and afterwards dismantled. Almost all remaining casks are bottled by now. There are no more Banff bottles in regular trade. This Chieftain's Choice bottling was one of the most economically priced Banff bottlings. Will it therefore rise in value? Three reasons why this is unlikely:

A) It's not an original but an independent bottling. This beats down the price significantly.

B) These bottles were already too expensive in 2000 to still be drunk in significant numbers. Most of them will have survived and are now sitting in the cabinets of the common-or-garden collectors.

C) The bottler bottled several casks of this kind over the years. There's a high probability that other bottles are ranked higher by collectors.

All in all Banff is a very unprofitable distillery for value-collectors. But if you want to have a complete collection you need this bottle, of course. It's also not a good malt, since the distillery was closed and dismantled due to water shortage and quality problems. Don't drink the bottle and don't assume that anybody will want to have this bottle in the coming 20 years.

Macallan 12 y.o. 0.7l and 1.0l

Macallan is one of the most important distilleries in Scotland. But you have to learn to tell high-circulation bottles from low-circulation series. The 12-year-old bottling had the highest circulation beside the 10-year-old. If one bottle is widely spread, it's this one. In 1999 the bottle design changed. For a complete collection you need the old, round tube.

You will never realise a good price with bottles sold in the millions. Yet the value of these bottles increased by 100% in recent years, since Macallan discontinued this series and now only offers their younger whiskies without an age statement. Allow me a word on the 1.0l bottles: They are not very popular among collectors because they are too tall for most cabinets. Only with really rare bottles it doesn't matter whether you have a 0.7l, 0.75l or a 1.0l bottle.

Macallan 25 y.o. 1975/2000

All older Macallans are suited for collecting without restrictions, especially if the vintage is printed on the label, no matter how small. While this bottle was sold for 173 euros in 2000, the remainders of the 25y.o./1971 were already sold for 254 euros in 2002. This represents a price increase of 50% over just a few years.

CAUTION! Due to the limited warehouse capacities of Macallan the recently launched 25-year-olds didn't have a vintage anymore. This is a considerable drawback for collectors. Still these bottles reached extreme prices of 750 euros among collectors in 2014. You couldn't do anything wrong.

Glenallachie Signatory 1991

This distillery runs at full capacity. Signatory replaced the 1991 bottling with a bottling from the same vintage but with two additional years of maturation. In 2002 the bottle that was two years older only cost 3 euros more.

However, collectors seek after another bottling. It's the old 12-year-old original bottling. Should a new original bottling be launched, no one will be interested in the Signatory bottling anymore. From a collector's point of view this bottle is meant to be consumed soon - it also tastes quite good.

Springbank 21 y.o.

Springbank had been mothballed for a longer period of time, and there are no more casks available from the time before closing (1989). All bottles are sold-out. Not until 2013 was the next 21-year-old bottled in a differently-shaped bottle - a sure sign that the old bottle shape remains recognisable.

A collector wishing for an increase in value had to have this bottle. The remainders of this bottling were sold for 159 euros in 2002, which means its value increased by 70% over two years. Moreover, this bottling is popular among connoisseurs, which reduces stocks further. In 2014 collector's bottles sold for prices around 500 euros.

Bowmore Sea Dragon 30 y.o.

Also the important Bowmore distillery suffers from exhausted warehouses caused by the malt whisky boom. Since the beginning of the new millennium there has been a dire shortage of casks aged 30 years or more. The 30-year-old is also very popular among connoisseurs.

However, the beautiful ceramic decanter is detrimental to a massive rise in value. Collectors appreciate the motif, and many filled bottles ended up in cabinets. Besides, a little alcohol always evaporates through the pores of the ceramic. Decanters are never as airtight as glass bottles. Decreased liquid levels make reselling difficult. Still, the price of the bottle has risen from 132 euros in 1996 to 238 euros in 2002. That's an increase by 80% in 6 years. In 2014 collector's bottles reached prices of more than 2,000 euros.

Loch Lomond

This is the original no-age-statement bottling from Loch Lomond. Specialist shops sold the first bottles as rarities for about 20 euros in 1998. Today you can find it in the supermarket for about 15 euros. It's of limited quality. You can write off the 20 euros. No connoisseur will drink this whisky.

However, it's seldom advisable to purchase first bottlings. You should rather wait and watch from a safe distance how a new malt develops. For example, the Glengyle distillery, which has been re-erected in the old buildings, is currently selling their first bottlings directly. 270 euros for a whisky that hasn't even been distilled yet! Only one party is making a profit here, and that's the distillery.

Loch Dhu 1.0l

The black malt Loch Dhu is an exception. Started as an experiment, the market didn't accept it. The taste of this extremely coloured malt was just too bad. After a few years of production the experiment was ended. Almost all bottles were opened out of curiosity.

Launched in 1998 for 39 euros, the final bottles reached retail prices of 75 euros - an increase by almost 100% in 4 years. Due to the extreme scarcity also the 1.0l bottles are sought after. In 2014 the bottles reached prices of about 200 euros.

Ben Wyvis Signatory 1968

It's impressive to own such a rare bottle. It's been the only bottling of this malt in many, many years. There are rumours about an original bottling in Canada before 1977.

Three casks were bottled in 2000, and the initial price of 1,150 euros was wishful thinking. By far not all bottles have been sold yet. The prices have even come under pressure because the market didn't accept the bottles. Moreover, there's a tenacious rumour that the former owner of the distillery still has some casks and is soon going to launch a new original bottling. But that may also be a defensive rumour spread by the competitors of Signatory. They're angry because Signatory was allowed to bottle all three casks.

Caperdonich Gordon & MacPhail’s 1968

The Caperdonich distillery produced swiftly under the pseudonym Glen Grant No. 2. A lot of malt was produced, and an independent bottling of an active distillery is not very sought after among collectors (cf. Glenallachie). It's no special delicacy either, and so you couldn't do much more than to give this to your best friend as a present for his 40th birthday in 2008.

The stagnation of the price at 95 euros in 2002 highlights the situation. But nothing is more constant than change. In 2002 the distillery was mothballed due to the recession in the wake of the burst of the internet bubble. In 2011 it was dismantled for good. Today bottles distilled in 1968 regularly reach prices of 200 euros and more.

Johnnie Walker Blue Label

Blended whiskies are not collected but drunk. Even if they are as elaborate and expensive as the Blue Label of the formerly biggest blended whisky brand of the world. Only low-circulation pre-war blends reach appreciable prices at auctions.

Only malt whiskies play in the Champions League. If you consider that ten thousands of bottles of the Blue Label are sold worldwide each year, you don't have a unique bottle even if they're individually numbered. Prices stagnating for over a decade confirm this.

For ambitious would-be collectors my remarks surely were unpleasant. I want to say sorry for that. Extreme examples, strong words and exaggerations are means to exemplify basic correlations. My goal was to spare you negative future experiences as a collector.

5. Recommendations

Let's be constructive for a change. Which malt whiskies are suitable for collecting anyway? The legendary Black Bowmore had an introductory price of already more than 125 euros. Except for the Loch Dhu the cheap examples mentioned above showed no rise in value. At the beginning the ambitious collector wishing for a maximum increase in value should aim for bottles with retail prices of about 100 euros. Of course a bottle costing 70 euros is OK once in a while, too. The important thing is that the bottle is more expensive than what the normal consumer is willing to pay. However, it also mustn't be too expensive, because then the increase in value would be too small. Auction proceeds also don't skyrocket, and auctioneers charge higher and higher premiums.

To say it again: The numerous bottles costing between 30 and 40 euros don't rise in value significantly. The distilleries simply produce too much of them. The pictures of the pallets with collector's bottles shown above highlight this. The cheap bottles leave Scotland in large containers.

But there's also an upper limit. If the original retail price is already high, the distilleries have already included the rise in value over the coming years in the retail price. The upper limit can't be clearly stated. It will be around 200 or 300 euros in 2014.

6. Which Distilleries to Collect?

Which are the distilleries that are actually sought after? Before we talk about distilleries, let's talk about the bottlers. I don't know any independent bottler beside Gordon & MacPhail that has ever scored high collector's prices. And I don't mean some hundred euros for an old bottle. I mean really high proceeds of more than 1,000 euros. Even G&M only scored such prices with bottlings they produced on behalf of the distilleries with official labels. As a collector you can easily dismiss their own bottling series such as MacPhail's or Glen Avon.

Collectors seek originals - not copies. No matter how fabulous the 1968 Signatory Bowmore might look, it's there to be drunk. A hardcore collector wouldn't pay anything for it. The Silent Stills Edition of Signatory is no exception. The Port Ellen original bottlings (Annual Releases) regularly reached higher prices than the Signatory Port Ellen wooden cases with a miniature and a piece of cask. Diageo's Rare Malts Selection is an exception. Since the bottler of the series was also the owner of the distilleries, this series took the status of an original bottling. Only when there have been no more original bottlings for several years, these bottles start to increase in value.

Finally let's talk about the distilleries themselves. Auctions of old malt whisky bottles have the biggest influence on the value development of young whiskies. Only distilleries that already had malt whisky bottles on the market shortly after World War II, or even better before the war, have an actual chance to reach high prices among collectors. The big auctions in Scotland have a model function. Thus there are only about a dozen distilleries with a potential for an exceptional increase in value.

7. Tips for Your Purchase

1. Only buy original bottlings, not independent bottlings.

2. Only buy bottles from the top distilleries (Macallan, Bowmore, Springbank, Glenmorangie, Highland Park,...) Which other distilleries? Islay? - sure! Lowland? - rather not. Speyside? - yes and no. Definitely the old distilleries such as Mortlach, Linkwood, Glen Grant or Strathisla. But stay away from young distilleries such as Clynelish, Braeval or Teaninich.

3. Buy special bottlings. Not Bowmore 17 y.o. but rather Bowmore Claret, not Macallan 15 y.o. but Macallan 18 y.o. with vintage or even better Gran Reserva, not Glenmorangie 18 y.o. but rather bottles with a special finish such as Tain l'Hermitage or Sauternes Finish. In general every bottle with a vintage is suitable.

4. The retail price should be between 70 and 250 euros. Watch the market and read a lot. When individual bottles show a strong increase in value, it's usually too late. It's hard to recoup this increase in value over the years.

Selling your collector's bottles is hard. The exceptional specimens can be sold at auctions. Big auctioneers are only seldom interested in bottles worth less than 300 euros. With these bottles their agio is too low to make a profit. Get into an optimum position with strategic purchases. Then you just have to wait between 10 and 30 years before you can reap the benefits of your labour. Only few bottles in your collection will increase in value exorbitantly, but some will for sure.

To reward you for hanging on until the end I want to give you a hot tip: In 1996 a G&M Glen Grant Malt from 1936 cost 485 euros. In 2006 a 1936 G&M Mortlach already cost 1.099 euros. With these old malts only the vintage is important. There are no more differences between the distilleries. Within 6 years you could get 2.3 times the value.

The ratio won't change much in the future. You just have to take slightly younger malts. Glenlivet 1948 is a very rare post-war vintage, for example. Only little barley was available for distillation. The lion's share was given to the population as bread. The same holds true for the 1949 Glen Grant. The period of starvation after the war took longer in Britain than in other countries, and food stamps were still used for years in Scotland. This means that only very few casks from these vintages were available and only very few bottles are left.

8. Addition

P.S. 2014 amendment: This tip was published in 2003. Today these bottles are all sold out and the vintages from the 1950s have taken over their role.

I wish you good luck with your collection.